Do you run for safety and move your stock market investment into a low interest savings account or do you stay put after last weeks decline?

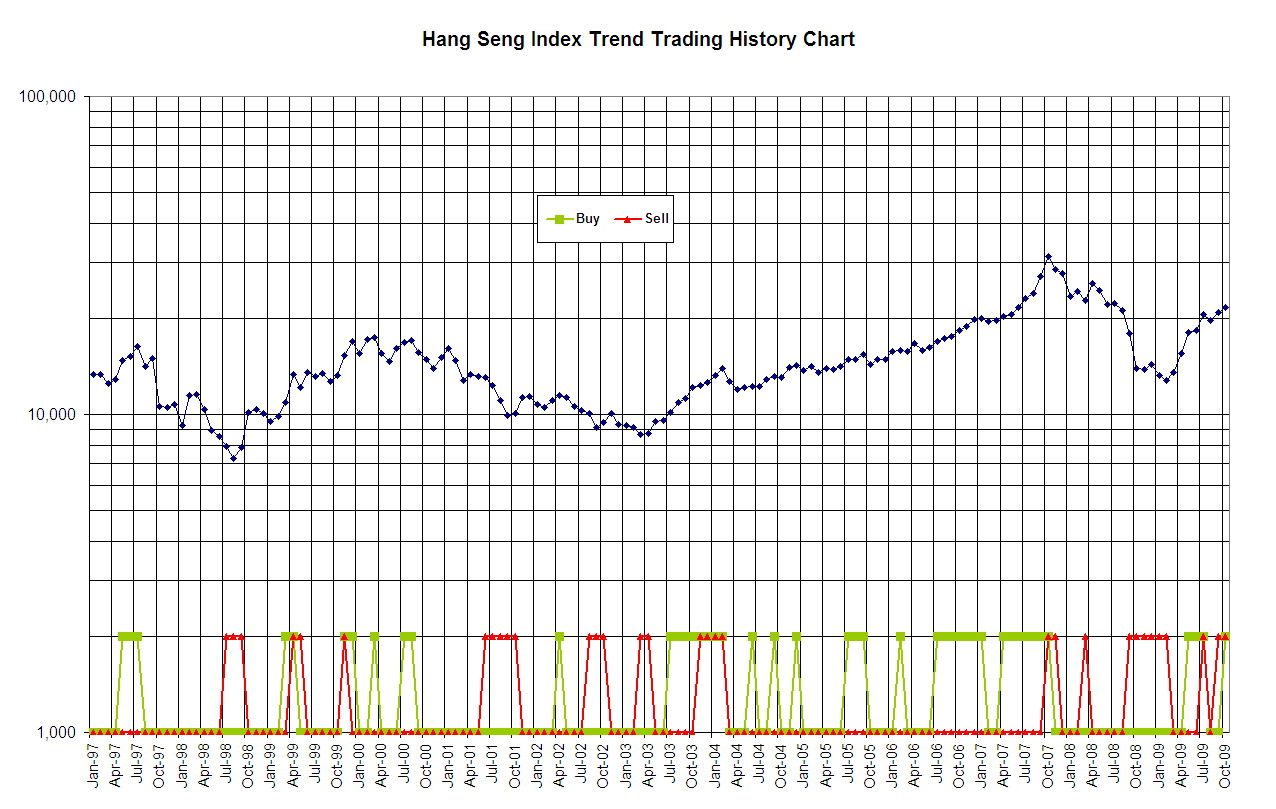

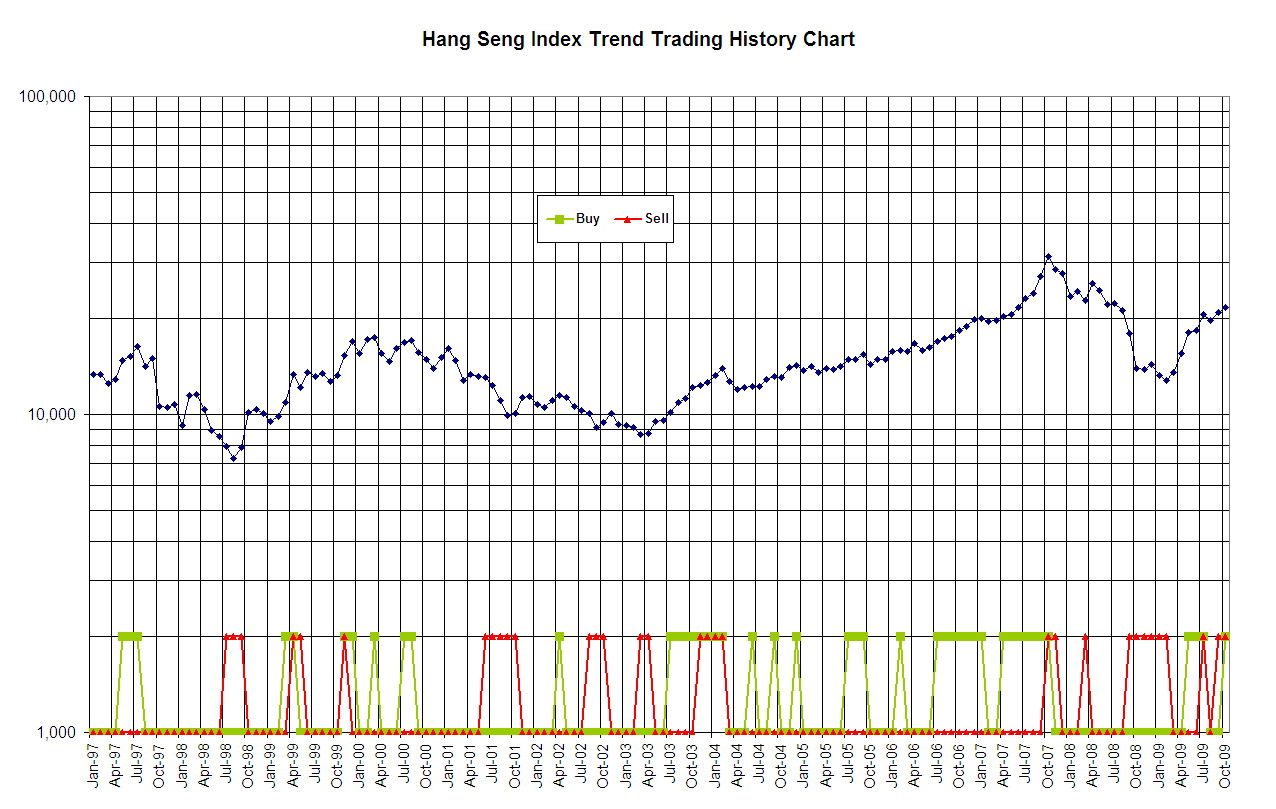

Every month, I use the Stock Trend Investing system to decide what I am going to do. This system provides me with buy-indications, correction-warnings or sell-warnings for a number of stock market indices around the world. Accordingly I make changes in my stock market investment.

All indices that we follow had a lower ending in October than their September ending except for the Dow Jones Industrial Averages Index, the Hong Kong Hang Seng Index and the Chinese Shanghai Composite Index. The Dow’s October ending was almost identical to a month ago. Thus the only indices that we follow and that showed real positive gains during October are the China related indices.

What buy indications and warnings do we have now for your stock market investment?

Overall the trend is still up with some warnings for a possible temporary correction.

The US indices do not give us a buy indication but give still a warning for a correction since they went up so much during the last period.

In general the European stock market indices do not give a specific buy indication, sell warning or a correction warning for our stock market investment after their declines in October.

In Asia, Hong Kong and Shanghai still show sufficient positive momentum and trigger a buy indication while both at the same time provide a warning for a possible correction since they increased so much during the past few months.

The Japanese Nikkei does not give any specific indication, signalling to us to hold our holdings and not to ad to them. The Sensex in Mumbai continues to give a warning for a correction. Even after last months decline, it still has gone up so far during the past period that you should be aware of the possible correction.

Gold has gone up for 4 months in a row and is on a roll. No warnings yet that it has gone up too much or so. Our system gives for Gold a buy indication.

What I will do

Given the current situation, I do not increase or decrease my stock market investment. I will see if I sell the put option I have bought last month on one of the European indices with some profit. If I do that, I will buy a put option on one of the US indices (S&P or NASDAQ) to cover for or benefit from a possible correction. However, since the stock market indices in the world follow each other in general, I may decide to keep my put option on one of the European indices since I expect them to follow any correction in the US markets. In this way I save some trading costs.

I do not buy any Gold yet since I have not figured out what for me the best way is to buy Gold.

Please leave a comment to this blog post and share with us what you will change in your stock market investment after the October closing.

In the beginning of 2000, I did not have my system yet for recognizing market trends and when to make or when to get rid of your stock market investments. During the boom years before I was always afraid that I was too late to step in since the markets had gone up so far already. And every month I was proven wrong since the markets went up further.

In the beginning of 2000, I did not have my system yet for recognizing market trends and when to make or when to get rid of your stock market investments. During the boom years before I was always afraid that I was too late to step in since the markets had gone up so far already. And every month I was proven wrong since the markets went up further.