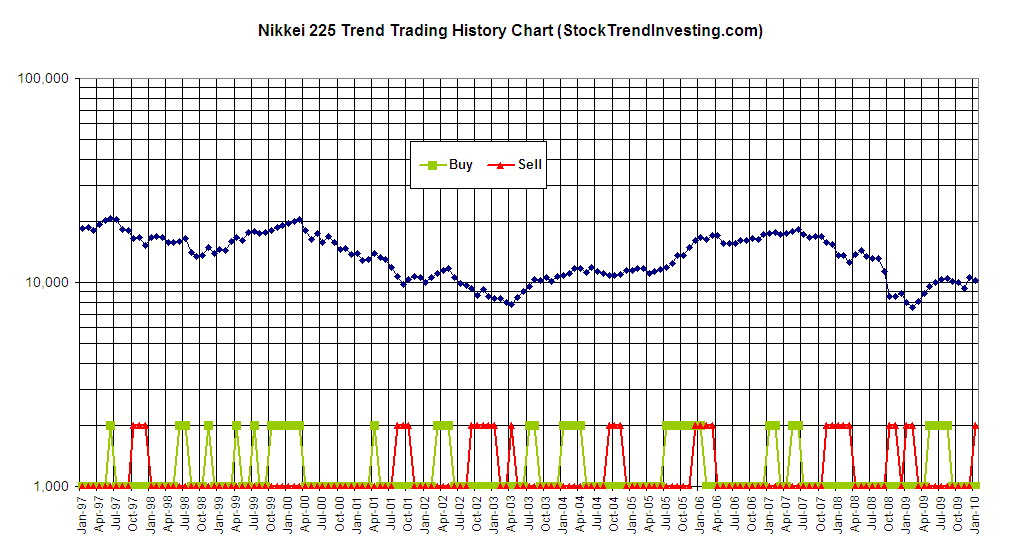

Five years from now, Stock Trend Investing will be a thriving online advisory service that helps busy, well-educated and successful people around the world making a better investment return on their savings in the stock market compared to what they would get on their savings account or with the buying and holding of stocks.

We do this by providing training and regular advice following a simple and proven methodology that takes only one hour per month.

In this way, we provide a growing group of hard working people with the possibility to create more wealth for their family and themselves, reaching their financial independence earlier, enhancing the quality of their lives.