April 2011

Trend Following the Stock Market like a Hedge Fund Manager

Submitted by Van Beek on April 28, 2011 - 05:00You have the freedom to follow the trends of your choice. Others don't.

Managers of mutual funds cannot apply trend following the stock market in their daily job. Hedge fund managers can. And you as well can use trend following the stock market. In this way you grow your savings faster than most mutual funds can do.

Reliable Stock Market Trend Indicators that are Simple to Follow

Submitted by Van Beek on April 27, 2011 - 04:53Stock Trend Investing provides reliable and simple stock market trend indicators

Here are a number of simple and effective stock market trend indicators for long-term trend following of index ETFs and mutual funds.

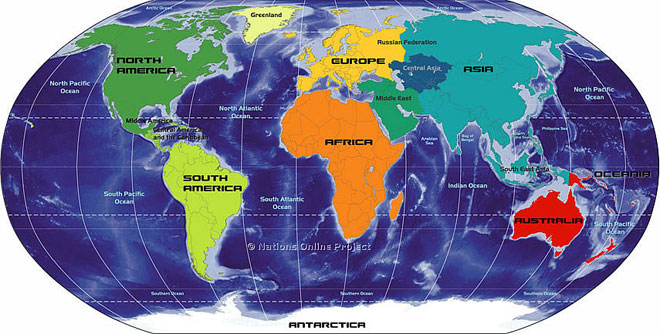

These trend indicators apply to the major US stock market indices as the Dow, S&P 500 and NASDAQ as well as to major indices in for example Europe and Asia.

Geographical Diversification Lessons from Index Investing for Dummies

Submitted by Van Beek on April 26, 2011 - 08:09

Get the benefits from a global geographical diversified portfolio of index funds

Once your stock investing portfolio is large enough, you can easily use index funds to diversify your investments over different regions in the world. Such a diversification has a few advantages that we will list below.

Here are four reasons for diversifying your stock investments geographically around the world:

Rebalancing Your Portfolio of Geographical Index Funds

Submitted by Van Beek on April 21, 2011 - 13:10

A geographical diversified portfolio of index funds offers the opportunity to rebalance

One reason for diversifying your stock investments geographically around the world is the portfolio rebalancing opportunity.

Here are two quotes from Index Investing for Dummies regarding portfolio rebalancing:

“The best way to raise cash (should you need it) is not through dividends but through regular portfolio rebalancing.”

The Small Cap Lesson from Index Investing for Dummies

Submitted by Van Beek on April 20, 2011 - 10:18

Index Investing for Dummies Review

Submitted by Van Beek on April 19, 2011 - 11:12

Index Investing for Dummies is a very useful book about investing, both for beginners as for investors with more experience. It explains and provides the tools for a simple, straightforward and effective approach for long-term investing.

In summary, you can say that it advocates buy and hold investing with low cost ETFs and Mutual Funds that follow well defined stock market indices.

Valuation-Informed Indexing - A Long-Term Investing Approach

Submitted by Guest on April 18, 2011 - 15:06As part of our intention to show you different long-term stock market investing strategies, here is a guest post by Rob Bennett on the Valuation Informed Indexing approach.

Stocks Index Investing Funds for Dummies

Submitted by Van Beek on April 16, 2011 - 12:28This page shows a number of stocks funds that are listed as well in the book Index Investing for Dummies and that are of interest for Trend Investors. This book lists a range of low cost Index ETFs and Mutual Funds that follow indices that are worth following. Index Investing for Dummies lists many more funds than the ones below.

Typical Trend Following Questions

Submitted by Van Beek on April 12, 2011 - 05:34

Other visitors of this trend following blog are sending us their questions and comments. You are welcome to do the same. In blog posts like this we answer some of these questions.

In this blog you find information about investing with the objective to make great long-term results without taking too much risk or too much of your time. Trend following of long-term trends in stock market indices is simple and straightforward.

The trend signals that we use to recognize the direction and changes in the trend are based on moving averages and patterns in the closing price. Here are two frequently asked questions on this:

S&P 500 Long Term Trends April 2011 Update

Submitted by SP 500 on April 5, 2011 - 06:00Boring... the S&P 500 ended March 2011 about as it began the month. It is up 0.2%.

Long-term trends in stock market indices are boring. They change in general very little. In most months, there is nothing new to tell. It is the same this month. The world is in turmoil, with revolutions in the Middle East and Norhern Africa and a terrible disaster in Japan.

But in the long-term trend for the S&P 500, there is no change.

The 4 different S&P 500 Trend Signals are all pointing up-wards.

Click here for the updated Trend Signal overview and for the links to the S&P 500 history charts.

Get trend signals for other indices, by signing up for our free newsletter and by trying our risk-free trial membership for the Stock Trend Investing System.