outlook

Should Stock Trend Investors show patience or bold action during March

Submitted by Van Beek on March 2, 2010 - 05:53Do you know now how the Asian, European and US stock markets did during February 2010? Did they go up or down and how shall someone investing in stock market trends take action on these developments? Here is an easy overview.

In summary, the main US markets went up during February, the main European markets went a little down, except for the UK and the Asian markets went up except for the Japanese Nikkei.

Get out of the Japan stock market and not because of theToyota recalls

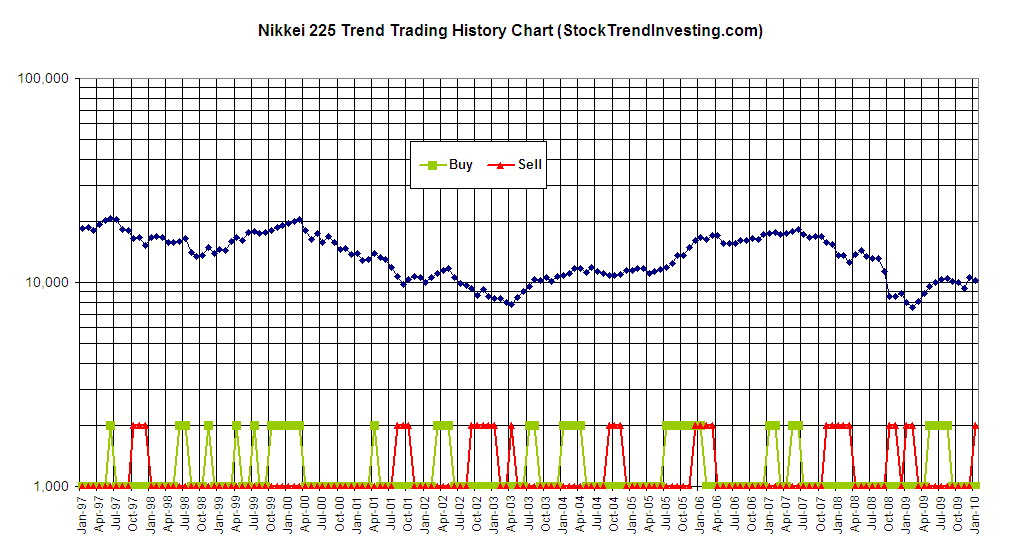

Submitted by Van Beek on February 11, 2010 - 02:36The Stock Trend Investing system indicates after the closing of January to sell your investments in the Japananese Nikkei now. The trend and pattern in the Nikkei index during the last half year tells the system that a prolongend down-turn in the Nikkei index is the most likely scenario for the coming 3 to 6 months. This has nothing to do with Toyota recalling a few cars.

See below the Nikkei 225 trend investing history chart. Contact us if you have any questions on this chart.

How to start in 2010

Submitted by Van Beek on January 4, 2010 - 06:32What shall you do as a Stock Trend Investor now in January 2010 when all stock market indices have increased like they did in December 2009? It depends.

Stock Trend Investors do not only look at the last month but also at what happened during the previous months. We are looking at trends that last for months and not just at what happens during an individual month. So, what are our conclusions on how to start in 2010?

Positive trend

For all eleven stock market indices that are currently covered by the Stock Trend Investing system, the trend is positive, except for the Japanese Nikkei index. This positive trend indication from our system means that we give the scenario where the stock market indices will continue to increase over the next few months the highest probability.

Nikkei 225 Index Trend Investing: did you get out too early?

Submitted by Van Beek on December 29, 2009 - 08:26Has the Nikkei 225, the Japanese stock market index that has been on a losing streak for a few months, now turned around? During this month, the Nikkei index has been gaining and during the last week it has hit its highest point in 4 months.

In the beginning of December, the Stock Trend Investing system warned that if the Nikkei 225 would decline another month during December, it would issue a sell warning for your holdings in funds that are expected to follow the Nikkei. We noted that those investors who firmly believed that the Nikkei would decline again during December, could as well sell already.

Which stock market indices increased during November despite Dubai

Submitted by Van Beek on December 1, 2009 - 16:10Do you know if the whole Dubai issue has made the stock markets close lower or higher at the end of November compared to a month ago? With all the fuss around Dubai, one could easily forget that most stock market indices actually closed higher at the end of November than at the end of October. What does this mean for the Stock Trend Investing investor?

In the beginning of 2010, Stock Trend Investing will launch its membership service. Members will receive on a monthly basis recommendations how to capitalize on the trends in the stock market indices around the world. Till that time, we provide you already with some free insights. Sign up for our free newsletter in case you want to be notified when our new service will be availble exactly.

Now, let’s look at what the Stock Trend Investing system tells us about what happened to the trends in the stock market indices during November.

US Markets

For the US markets, the Dow gives a buy signal but the other indices (Nasdaq, NYSE, S&P 500) tell us to hold. For the Nasdaq and NYSE we still get a very minuscule correction warning. If you want to increase your holdings in the US markets, look first at index funds that follow the Dow Jones.

Gold and India

The Mumbai based BSE (Bombay Stock Exchange) tells us at this moment that there is still a fair chance on a short-term correction. This would be caused by a too high growth in the index during the last 6 months.

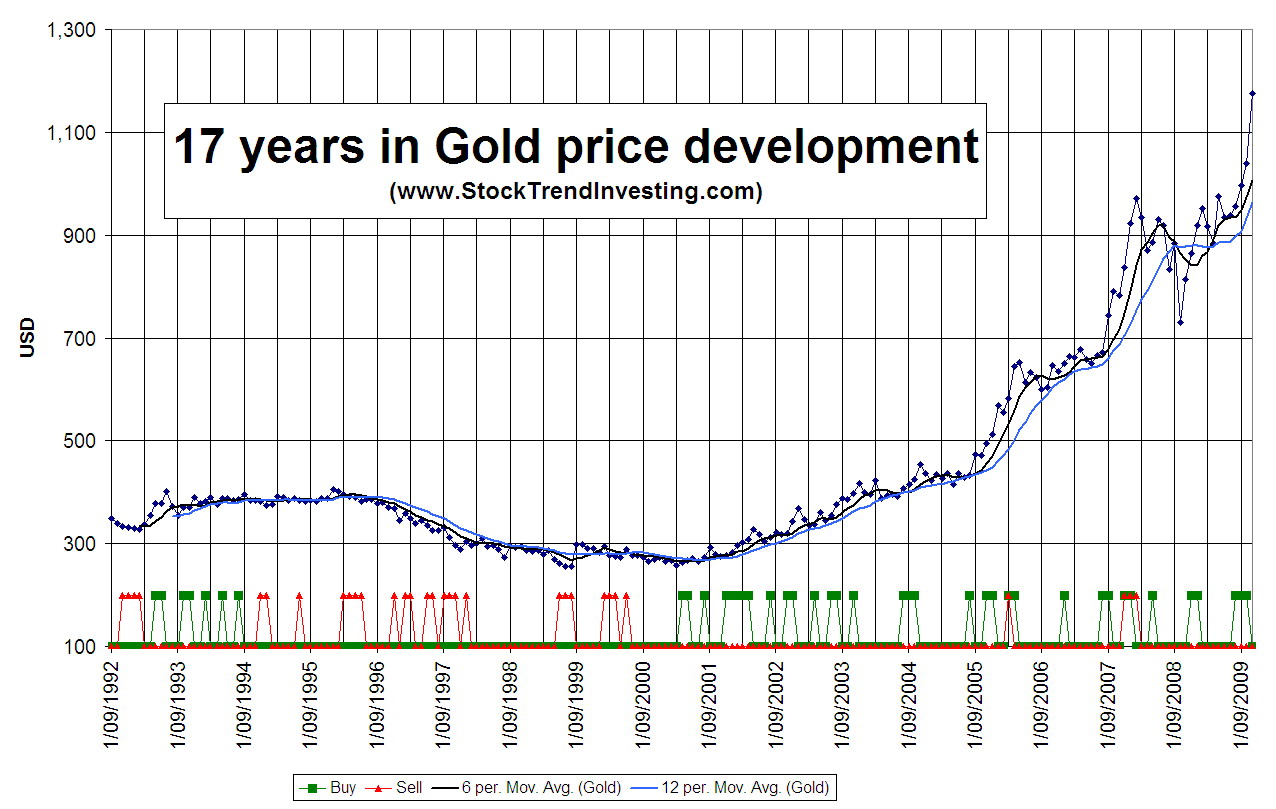

Gold is on a roll the last months and actually the whole last decade. We see no indication that this momentum would change. However, the prices have gone above the normal expected trend lines.

European Markets

The three main European markets (FTSE, DAX, CAC 40) tell us to hold our positions. If we see a positive result during December, we will get a buying signal here again.

East Asian Markets

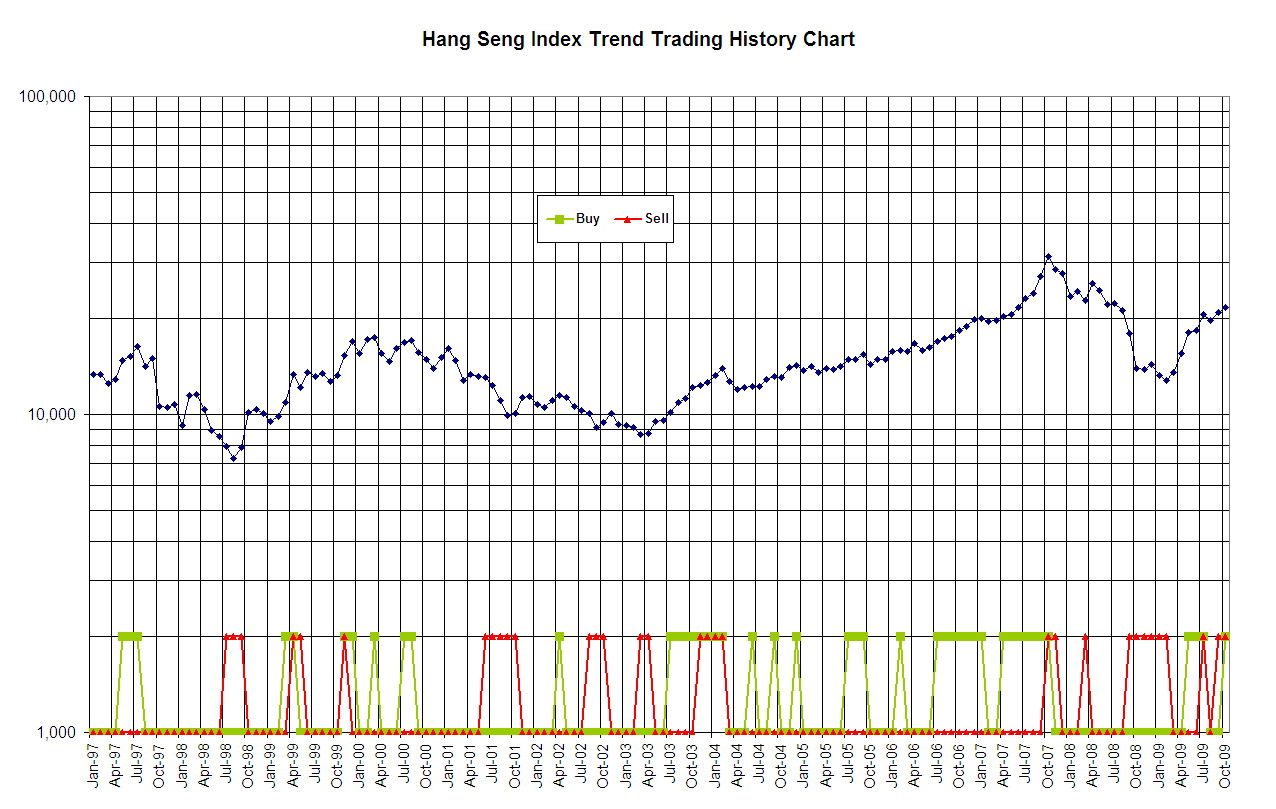

The Hong Kong Hang Seng Index keeps giving positive buying signals and so is the Shanghai Composite Index. Since the Hong Kong index has increased so considerable during the last half year, we still see some short-term correction risk.

The Japanese Nikkei declined again during November as one of the few indices in the world. Our system gives still the benefit of the doubt and tells us to wait and see for another month. However, trend investors who are confident that the Nikkei index will also drop during December, can just as well sell their Nikkei related holdings now.

Overall, for investors who would like to increase their stock market investment, we recommend to look at China indices and the Dow Jones Industrials Index at this moment.

When you are interested to be notified when the new Stock Trend Investing membership will be launched, we recommend you to sign up for our newletter.

Do you sleep like a baby when your stock market investment devalues

Submitted by Van Beek on November 1, 2009 - 09:26Do you run for safety and move your stock market investment into a low interest savings account or do you stay put after last weeks decline?

Every month, I use the Stock Trend Investing system to decide what I am going to do. This system provides me with buy-indications, correction-warnings or sell-warnings for a number of stock market indices around the world. Accordingly I make changes in my stock market investment.

All indices that we follow had a lower ending in October than their September ending except for the Dow Jones Industrial Averages Index, the Hong Kong Hang Seng Index and the Chinese Shanghai Composite Index. The Dow’s October ending was almost identical to a month ago. Thus the only indices that we follow and that showed real positive gains during October are the China related indices.

What buy indications and warnings do we have now for your stock market investment?

Overall the trend is still up with some warnings for a possible temporary correction.

The US indices do not give us a buy indication but give still a warning for a correction since they went up so much during the last period.

In general the European stock market indices do not give a specific buy indication, sell warning or a correction warning for our stock market investment after their declines in October.

In Asia, Hong Kong and Shanghai still show sufficient positive momentum and trigger a buy indication while both at the same time provide a warning for a possible correction since they increased so much during the past few months.

The Japanese Nikkei does not give any specific indication, signalling to us to hold our holdings and not to ad to them. The Sensex in Mumbai continues to give a warning for a correction. Even after last months decline, it still has gone up so far during the past period that you should be aware of the possible correction.

Gold has gone up for 4 months in a row and is on a roll. No warnings yet that it has gone up too much or so. Our system gives for Gold a buy indication.

What I will do

Given the current situation, I do not increase or decrease my stock market investment. I will see if I sell the put option I have bought last month on one of the European indices with some profit. If I do that, I will buy a put option on one of the US indices (S&P or NASDAQ) to cover for or benefit from a possible correction. However, since the stock market indices in the world follow each other in general, I may decide to keep my put option on one of the European indices since I expect them to follow any correction in the US markets. In this way I save some trading costs.

I do not buy any Gold yet since I have not figured out what for me the best way is to buy Gold.

Please leave a comment to this blog post and share with us what you will change in your stock market investment after the October closing.