August 2011

Are High Dividend Funds Now Your Best Option?

Submitted by Van Beek on August 30, 2011 - 10:10

High dividend fund DVY compared with S&P 500 fund SPY for 2006 - 2011.

During times of economic turmoil and unrest in the stock markets, many investors start asking themselves if they would be better off when they invest their savings in high dividend funds.

Dividends Matter

Submitted by Van Beek on August 26, 2011 - 10:12|

The impact of dividends on the S&P 500 / SPY performance during bull and bear markets.

Do you forget to include the dividends you receive when you analyze your investing returns? You shouldn’t, because dividends can contribute significantly to your gains. |

Proven Long-Term Strategy for Stock Market Investing for Only $1

Here you find some relevant information about a stock market information service that can help you to decide when to buy mutual funds or index funds and when to sell these funds.

Simple Stock Market Investing Strategy - A Picture Says a 1000 Words

Do you care if this simple stock market investing strategy is called...

-

Trend Investing

-

Trend Following

-

Index Investing

-

Long-term Market Timing, or

-

Buy and Hold Plus.

When it works to grow your savings and build long-term wealth?

How Do You Know When To Buy Or Sell Stock Market Funds?

How do you know when to buy or sell stock market funds to get great long-term investing returns to grow your savings when...

-

The interest you get on on it is low and;

-

You have no time to study different investment opportunities?

Roubini Puts His Money in Cash - WSJ Video Interview

Submitted by Van Beek on August 13, 2011 - 10:43

Sell Right Now When You Are Just Back From Holiday?

Submitted by Van Beek on August 9, 2011 - 11:06|

Did the markets report a sell-off during your holiday?

Over the weekend I got from one of our members the following message: “Been on holiday for a week, should I still sell off my holdings?” Here is my reply that I sent last weekend. Maybe it is of any use to you. |

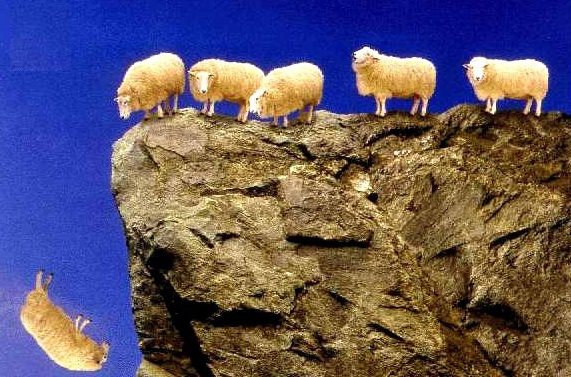

Is this Sell-off a Correction or the Beginning of a Bear Market?

Submitted by Van Beek on August 5, 2011 - 12:26

Are you falling of a cliff as well or do you use systematic and objective analysis?

Are you buying the dip or selling all your funds? Are you paralyzed by fear when markets drop more than 4% in a single day or do you stay calm and relaxed? How do you decide if you see this sell-off as a temporary correction or the beginning of a longer bear market?

Anybody, who tells you that he is absolutely certain that this is a correction or the beginning of a bear market, is lying or does not know what he talks about.

Nobody knows the future. But objective analysis can give us an indication of what will most likely follow.

You Need More than the S&P 500 to See the US Market Trend

Submitted by SP 500 on August 1, 2011 - 11:16After a hectic month, with

- a US debt default discussion,

- a rescue package for Greece and

- signs of slower than expected economic growth

The long-term trend signals for the S&P 500 are all unchanged compared to last month.

They are all pointing up.

But this is a time that shows clearly that looking at the long-term trend signals for one market index like the S&P 500 is not enough.

To see where the trend is going for the overall market, you better follow a number of different market indices.

At this moment we get for example the first warnings from the NASDAQ and NYSE indices for the start of a potential downturn.

Long-term trend signals for many emerging markets are pointing down. And Europe starts coloring red as well.