Market conditions seem to be as ambivalent as the weather these days. Last year was marked by uncertainty and turmoil, resulting in volatility that had not been seen since the end of 2008. However, recently stocks and commodities have been rising like crazy over the past seven months, and volatility has been squeezed out of the currency markets and hit new 3-year lows in the S&P 500 Index.

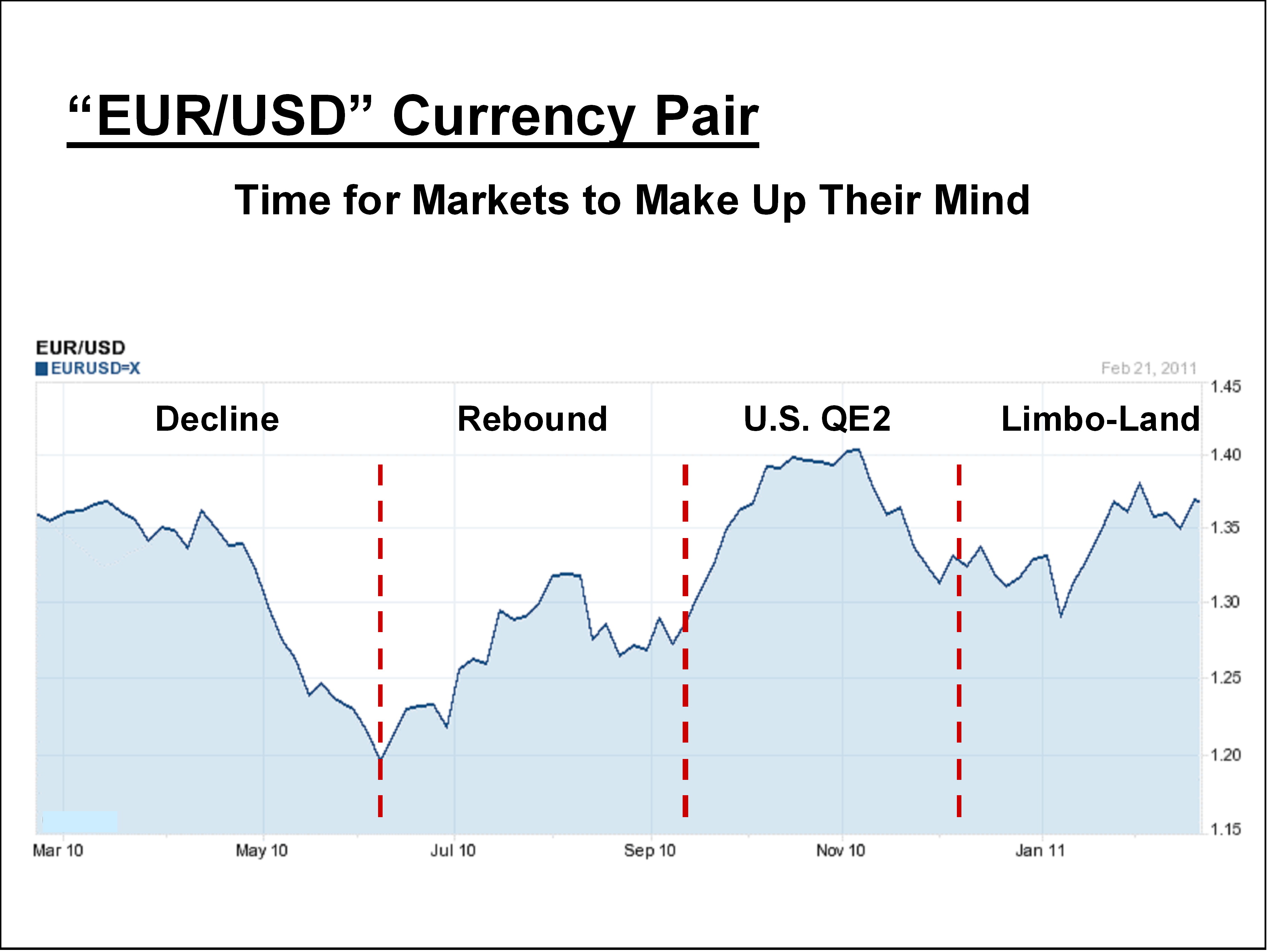

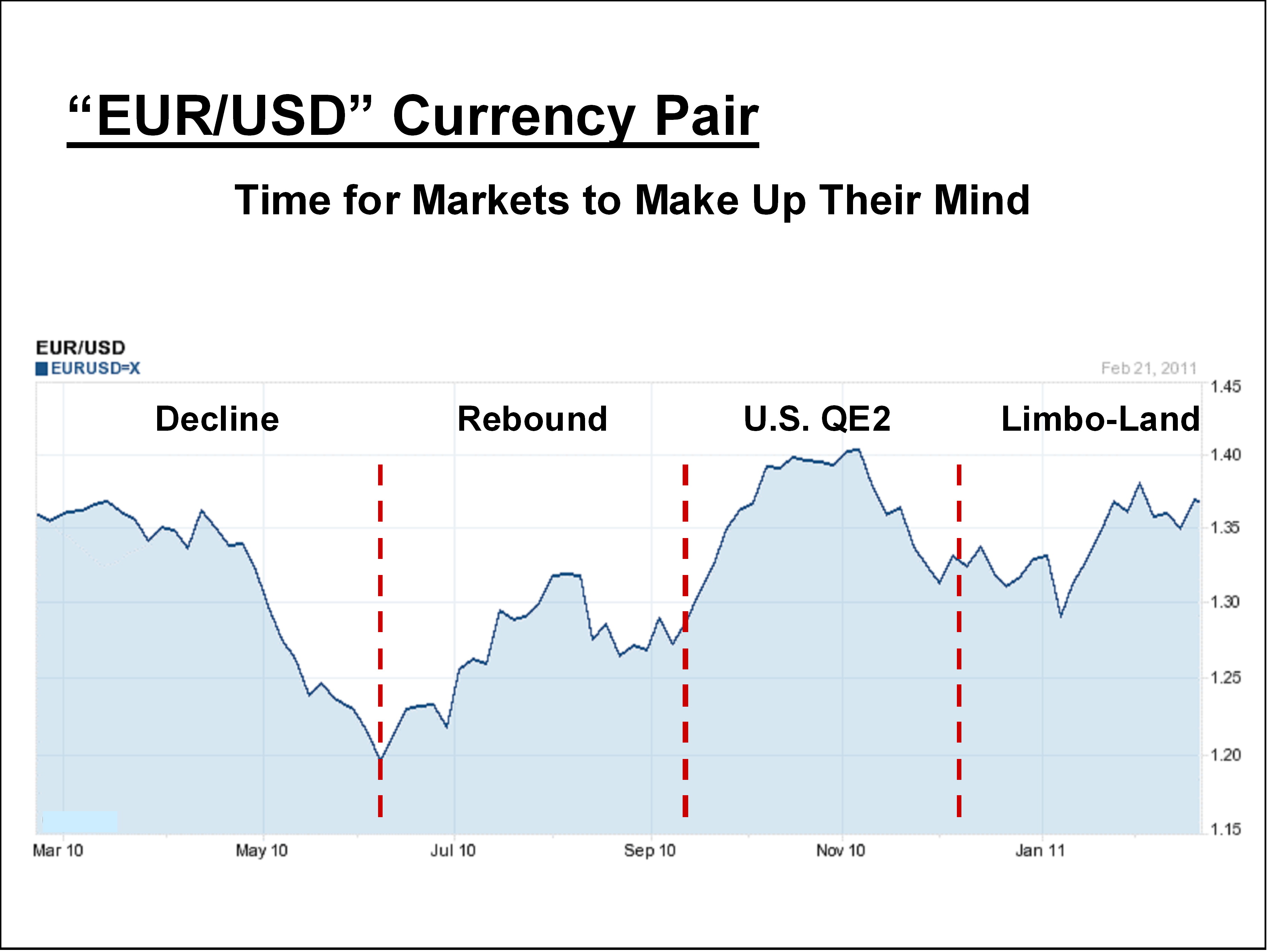

The Euro fell from its lofty perch last May due to debt and deficit issues with its smaller member states, but versus the Dollar, it seems trapped at the moment in a kind of limbo-land.

One of the most impressive trends over the past decade was the Euro’s ascension after its creation in 1999. The “EUR USD” relationship was to reflect years of planning by members of the European Economic Union to pool their efforts behind a single currency to challenge the reserve status of the U.S. Dollar. Parity with the Dollar may have been the initial goal, but that objective was achieved in 2002, followed by years of strengthening until $1.58 was reached and then abandoned.

The global economic slowdown caused the decline that continued into 2010 as low growth and deficit spending began to take its toll on the “PIIGS” (Portugal, Ireland, Italy, Greece, and Spain). Various programs were announced that brought back the confidence of the market to a degree, as evidenced by the “Rebound” section of the above chart, but the remainder of the past year has been filled with sideways “choppy” price behavior.

The general market perception is that the “winner” in the economic recovery “race” will be the victor. The U.S. central bank soon announced its Quantitative Easing program to buy back $600 billion in government bonds that weakened the Dollar, but a few bits of favorable economic news brought the Dollar back, resulting in the present “standoff”.

For the past four weeks the pair have hovered between $1.35 and $1.38. Stock markets have tempered their recent rises, and all markets appear poised for the next “rock” to be thrown into the “pool”. The turmoil in the Middle East has also stymied analysts in their tracks, not knowing what the eventual outcomes might be or portend. Trend investors are waiting patiently because periods of calm, similar to the present situation, are almost always followed by a severe breakout in one direction or another.

Economists that enjoy forecasting at times like these are split into two camps. One group believes that Europe still has a way to go to solve its debt problems and has forecasted a decline to the $1.15 range by October. The opposite group is more optimistic, favoring the European recovery effort over the United States and fixing a value of $1.43 twelve months out in 2012. The “bet” is clearly which region will get their act together first.

The underlying issue, however, is economic growth. In this era of globalization, the growth equation has firmly shifted to emerging market countries where labor costs are low and quality work ethics are high. Western countries have been off shoring jobs and wealth to these receptive markets for decades, and economists the world over believe these trends will continue for the next two decades or more. A new economic world order will be established with the “BRIC” countries, Brazil, Russia, India, and China, firmly ensconced at the top of the heap.

In the meantime, North America and Europe will continue to battle it out on the currency front, but the remaining 90% of the world’s population may not be paying attention.