- End of 12 Years of Monthly Stock Market Trend Updates

- Alternative Services for Trend Signals

- S&P 500 Trend Signal Email Alert

- Two Favorite Economics and Investment Newsletters

- Get Email Alert When S&P500 Trend Turns Down

- Currencies Impact Stock Market Profits

- Trend Investing Whip-Saw Reality

- Not Trend Following But Trend Investing

- How to Invest My Savings Safely for Good Long-Term Returns?

- Does Trend Trading the ASX Work?

Blogs

Outsourcing your wealth management or keeping it in-house

March 9, 2010 - 06:03 — Van BeekWhen do you outsource something in your business and does the same apply for your wealth management? In business you outsource those activities that someone else can do better and that are not a core competence to your organization. So, how does the management of your wealth stack up to that?

Is it part of your core competences or should it be? It is probably not part of your core activities when you look at how much time you want to spend on it. If an hour per month would do, that would be great. You prefer to spend your time on other matters. But managing your wealth is pretty important, isn’t it. It is your future.

Should Stock Trend Investors show patience or bold action during March

March 2, 2010 - 04:53 — Van BeekDo you know now how the Asian, European and US stock markets did during February 2010? Did they go up or down and how shall someone investing in stock market trends take action on these developments? Here is an easy overview.

In summary, the main US markets went up during February, the main European markets went a little down, except for the UK and the Asian markets went up except for the Japanese Nikkei.

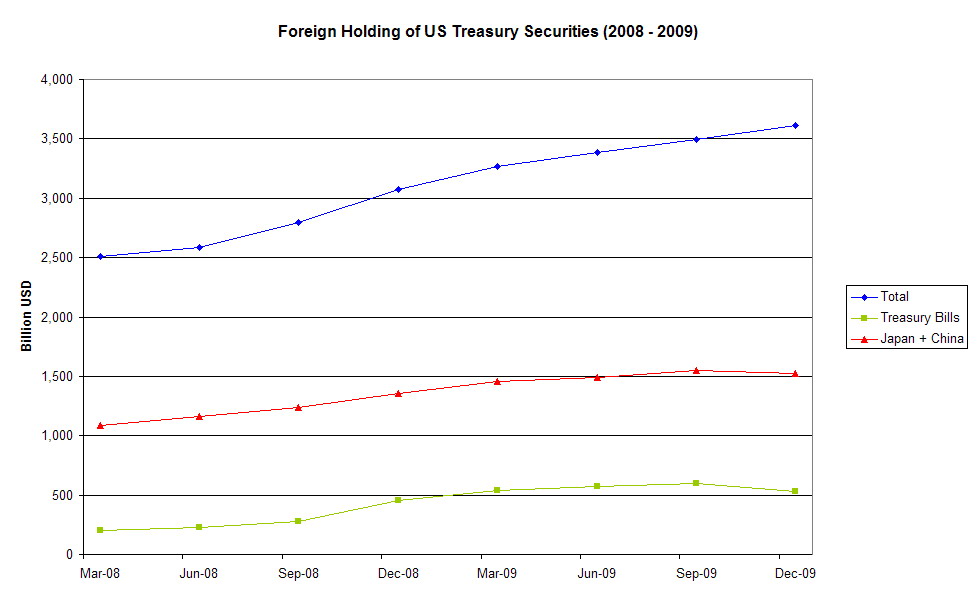

Foreign Holding of US Treasury Securities: a 10 year historic overview

February 17, 2010 - 08:01 — ResearchForeigners cut Treasury stakes; Rates could rise. This was the article in Yahoo Finance from February 16 based on a press release from the US Treasury that lead me to dive a little more into the foreign holding of US treasury securities. This article shows the historic graphs and my findings, like the chart below.

Foreign holding of US Treasury Securities 2008 - 2009