Is this Sell-off a Correction or the Beginning of a Bear Market?

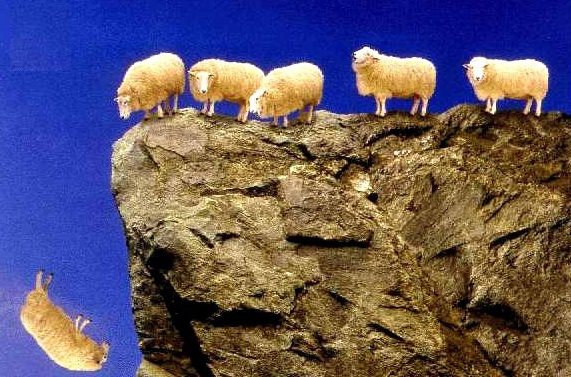

Are you falling of a cliff as well or do you use systematic and objective analysis?

Are you buying the dip or selling all your funds? Are you paralyzed by fear when markets drop more than 4% in a single day or do you stay calm and relaxed? How do you decide if you see this sell-off as a temporary correction or the beginning of a longer bear market?

Anybody, who tells you that he is absolutely certain that this is a correction or the beginning of a bear market, is lying or does not know what he talks about.

Nobody knows the future. But objective analysis can give us an indication of what will most likely follow.

Objective Analysis

What objective analysis do you use to decide if you now buy, hold or sell your funds when markets are falling of a cliff?

To watch the economic news on TV and to read what is posted online will not help you a lot. Messages are conflicting. Experts say the things that fit their own position. Few are impartial these days.

My advice to you is to define a systematic approach on how you deal with this type of a sell off situations in advance. At times when the markets do not panic like now, you sit down and define how you would act when sell-off situations occur. Create a set of rules for yourself that are objective and logical.

I have done that with my Stock Trend Investing system. Since I understand that not everybody has the time or capabilities to develop such a system, I share it with our members.

Systematic Investing

You can have your own system. Your system could be as simple as “buy and never sell”.

That does not give you the best long-term results, but if it provides you with peace of mind when markets sell-off, it is fine. It is much better than to panic, follow your emotions and reacting ad-hoc.

OK, now you want to know what I think. Is this sell-off a correction or the beginning of a longer term bear market?

First I want to make clear that I am a long-term investor. I do not want to act upon short term corrections. I do want to act upon signals that indicate the beginning of a longer term bull or bear market.

Before I tell you if I am long or short in the market now, I must tell you that I am rather safe than sorry. When I think that the risks are increasing I flee.

Correct?

Thus what do I think? Last Monday I shared with our members that many long-term trend signals for various markets are now pointing down. Consequently I would sell a large part of my holdings. That is what I have done last Monday.

Thus, being rather safe than sorry and following my long-term trend signals, I see it as a higher probability that this sell-off is the beginning of a longer term bear market than that this is just a short-term correction. But I could be wrong of course and then I just correct as well.

Next & Previous Blog Post

- ‹ previous

- 101 of 174

- next ›